Uncategorized

Plastic to Pixels: The Remarkable Evolution of Credit & Debit Cards

In the world of finance, there’s a fascinating story that revolves around the evolution of credit and debit cards. It’s a tale that starts not in the distant past but in the mid-20th century when a new form of payment was born. Before the arrival of plastic cards, folks carried cash or relied on local charge accounts at their favorite shops.

The Diners Club Card: A Bold Beginning

Imagine the year 1950. Frank McNamara, a businessman dining at a New York City restaurant, found himself without cash to settle the bill.

Instead of an embarrassing exit, he came up with an idea. What if there was a charge card that could be used at various establishments?

That idea led to the creation of the Diners Club Card in 1950, which allowed McNamara and his friends to dine without cash.

The Credit Card Revolution: Expanding Horizons

The success of Diners Club Card laid the foundation for a financial revolution. In 1958, Bank of America launched the first general-purpose credit card called the BankAmericard. It allowed customers to carry a balance over time, and soon, other banks and financial institutions followed suit.

The Debit Card Emerges: A Twist in the Tale

Fast forward to the late 1960s, and the concept of the debit card was born. Instead of relying on credit, a debit card allowed individuals to make payments directly from their checking accounts.

These cards offered a new level of convenience, eliminating the need to carry cash or checks.

From Imprinters to Chips: Technological Advances

Over the years, credit and debit cards evolved in response to technological advancements.

The iconic “knucklebuster” machines for card imprints gave way to magnetic stripe cards in the 1970s, significantly streamlining transactions. And in the 2000s, chip-and-PIN technology brought enhanced security, making card fraud more challenging.

Subhead 1: Contactless and Mobile Payments

The digital age ushered in yet another significant transformation.

Contactless payments, where you merely tap your card or phone to pay, have become increasingly popular.

Services like Apple Pay and Google Wallet turned smartphones into digital wallets, changing the way we make everyday purchases.

Subhead 2: The Future of Credit and Debit Cards

So, where are credit and debit cards headed next?

With ongoing innovations in fintech, the cards in your wallet are likely to evolve further.

Biometric authentication, virtual cards, and blockchain technology are just a few of the exciting developments on the horizon.

In conclusion, the journey of credit and debit cards from their humble beginnings to their present state is a testament to human ingenuity and our constant quest for convenience in the world of finance.

These cards have transformed the way we shop, dine, and manage our finances, and they continue to adapt to the changing times.

Stay tuned for what the future holds in this ever-evolving financial landscape.

The Rise of Digital Wallets

Imagine stepping out for a morning coffee.

Instead of fumbling through your wallet for cash or card, you simply reach for your smartphone and tap it at the counter.

Welcome to the world of digital wallets!

These nifty apps like Apple Pay and Google Pay have made payments a breeze. And the best part?

They’re secure, often requiring your fingerprint or a PIN for added protection.

Subhead 1: Contactless Cards and Wearables

Just when you thought tap-and-go was the pinnacle of convenience, enter contactless cards and wearables.

These cards are embedded with a tiny chip and antenna that communicate with card readers when placed close.

Wearable devices like smartwatches can now make payments with a flick of the wrist.

It’s like having your own payment genius!

Subhead 2: Biometric Authentication

Remember the days of signing the back of your card or entering a PIN?

Well, those are gradually becoming relics of the past. The future of payment methods is all about biometric authentication.

Think facial recognition, fingerprints, or even your unique voice.

These methods add layers of security, making it nearly impossible for imposters to access your funds.

The Blockchain Revolution

Ah, blockchain, the technology behind cryptocurrencies like Bitcoin. But its potential goes beyond digital coins.

Blockchain promises a more transparent, efficient, and secure way to process payments.

By decentralizing transactions and eliminating intermediaries, it could redefine how we pay for goods and services.

Imagine faster international transfers and reduced fraud, all thanks to this digital ledger.

Subhead 3: Cryptocurrencies in Commerce

Cryptocurrencies started as a geeky experiment and turned into a global phenomenon.

Now, they’re steadily making their way into mainstream commerce. Some companies already accept Bitcoin and other cryptocurrencies as payment. The advantages?

Lightning-fast transactions and lower fees.

While it’s not quite replacing your debit card yet, who knows what the future holds?

The Cashless Society

Do you still carry a wad of cash in your wallet?

If you do, you’re becoming increasingly rare.

The world is steadily marching toward a cashless society.

With the rise of mobile banking apps and digital payment platforms, the need for physical cash is dwindling.

It’s convenient, but it also raises questions about financial privacy and inclusivity.

Subhead 4: Personalized Payment Methods

In the not-so-distant future, your payment methods could be as unique as your fingerprint.

Some banks and fintech companies are exploring personalized payment options.

This might involve tailoring your card’s rewards and benefits to your specific spending habits.

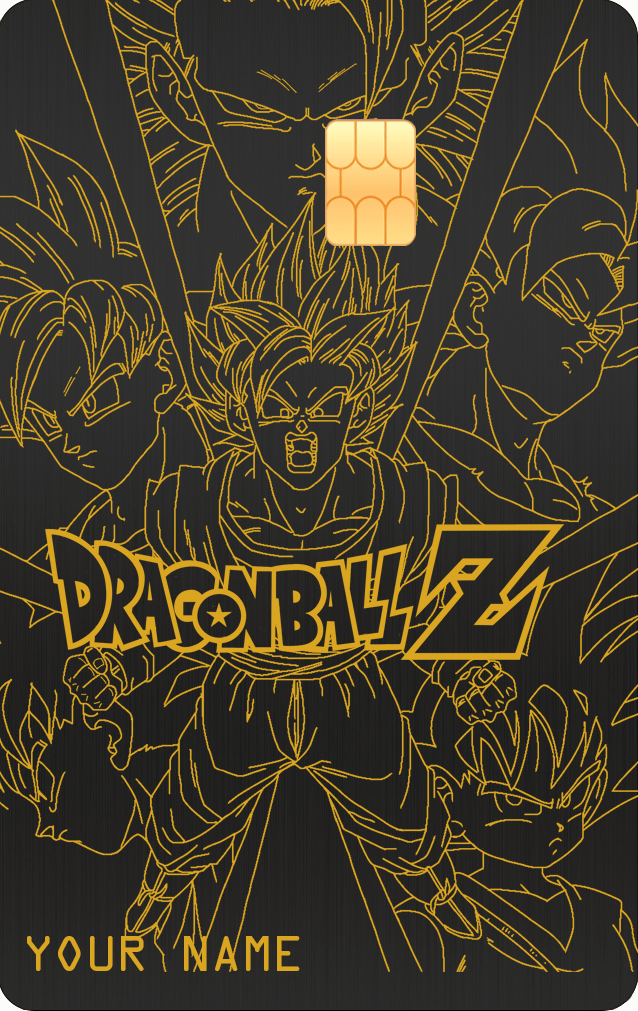

No more plastic cards give us our unique Metal Cards, We think you’ll love them!

In conclusion, the future of payment methods is a fascinating blend of convenience, security, and innovation.

From digital wallets to biometric authentication and the blockchain revolution, the way we pay for things is undergoing a profound transformation.

Whether you’re tapping your phone, verifying payments with your face, or exploring the world of cryptocurrencies, one thing’s for sure: the days of fumbling for cash or plastic cards are numbered. Welcome to the future of payments, where your wallet is more of a concept than a physical object.